Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

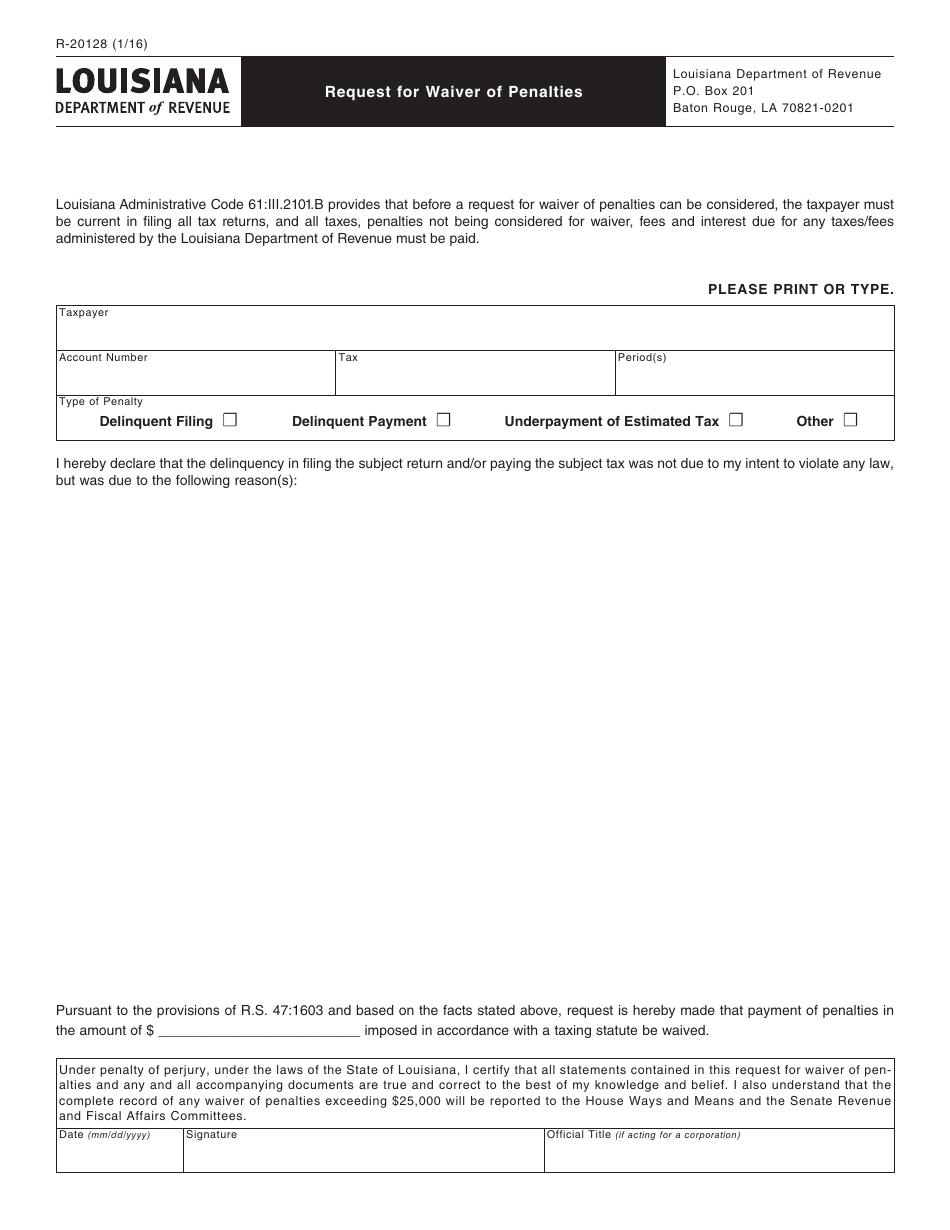

Asking For Waiver Of Penalty / Penalty Waiver Policy Pdf Free Download : Generally, exemptions from penalty will apply if:

Asking For Waiver Of Penalty / Penalty Waiver Policy Pdf Free Download : Generally, exemptions from penalty will apply if:. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Reasonable cause may exist when you show that you used ordinary business care and prudence and. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty). Instructions on using irs form 843 to claim a refund or ask for an abatement of tax penalties. To know whether you have a kra penalty, just log into your kra itax account;

It's a good idea to take a second look at your return if you have questions about your estimated tax penalty or need help explaining your circumstances to the irs to ask for a waiver or abatement, an. Examples include illness or death of the taxpayer or tax preparer, destruction of records by fire, flood or natural disaster, or other unusual situations that. To apply for a penalty waiver for any other taxes administered by the department that are not currently filed on tntap, you should fully complete a penalty waiver. Do you have questions about the open enrollment waiver process? The irs will not waive the penalty on the phone.

They always want the request to be in writing.

The irs will not waive the penalty on the phone. You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. Do you have questions about the open enrollment waiver process? To know whether you have a kra penalty, just log into your kra itax account; If extenuating circumstances kept you from filing your return or paying your tax on time, you can ask us to forgive penalties. Letter of waiver of penalty sample. If you miss an rmd, you're subject to a 50% penalty on the amount you should have taken, and didn't. Interest is never waived fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes. Reasonable cause may exist when you show that you used ordinary business care and prudence and. Find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. See below for a list of our most frequently asked an open enrollment waiver is a letter from opp that allows you to enroll in health insurance where can i get a waiver of the state or federal tax penalty for not having insurance? To whom it may concern, i am writing to ask whether letter of waiver for immigration sample.

If you are granted a waiver for your primary residence or small business, your waiver will extend the deadline to when you apply for a penalty waiver, we will ask you to include your business account number (ban) which you can find on your. They always want the request to be in writing. Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. Finally, if all other means have been exhausted, consider contacting. A hmrc officer who was not previously involved with your penalty decision will carry out a review if you appeal.

Do you have questions about the open enrollment waiver process?

To apply for a waiver of penalty, please sign into your tennessee taxpayer access point (tntap) account. Hello.,i am working in software company and because of my late opened salary account ,our company hr should draft letter for waiver of interest & penalty against notice and principal to pay? Interest is never waived fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. You must sign your request for a fee waiver under penalty of perjury. How to apply waiver kra how to pay kra penalties without money kra penalty waiver. Dope kenya addresses the following questions; Early learning tax credit frequently asked questions (faqs). Dear sir or madam, i am writing this letter respectfully requesting that you waiver my visa penalty due to. If extenuating circumstances kept you from filing your return or paying your tax on time, you can ask us to forgive penalties. Select the tax type at the. The irs offers waivers for specific tax penalties. Finally, if all other means have been exhausted, consider contacting. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

If you ask for a waiver for reasonable cause, you need to establish the facts for the issue you are having that keeps you from taking care of your however, if any penalties are reduced, the related interest is also reduced automatically. Request to waive late fee letter. How to avoid civil penalties. Hello.,i am working in software company and because of my late opened salary account ,our company hr should draft letter for waiver of interest & penalty against notice and principal to pay? The irs will not waive the penalty on the phone.

Tax penalty waiver online form property tax.

To whom it may concern, i am writing to ask whether letter of waiver for immigration sample. If you have been charged a penalty but believe you have reasonable cause (e.g. In 2001, the irs established fta to help administer the abatement of penalties consistently and fairly, reward past compliance if the representative will not override it, ask for the representative's manager. To apply for a penalty waiver for any other taxes administered by the department that are not currently filed on tntap, you should fully complete a penalty waiver. Generally, exemptions from penalty will apply if: Early learning tax credit frequently asked questions (faqs). If you are granted a waiver for your primary residence or small business, your waiver will extend the deadline to when you apply for a penalty waiver, we will ask you to include your business account number (ban) which you can find on your. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty). Penalty waiver request, offer of compromise or protest. The irs only removes penalties incurred in the first year. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. It is going to take at least a couple of months to resolve the issue. That said, there is no guarantee that the issuing agency will give in to your request, but it never hurts to ask.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Santos X Ceara Palpite / Botafogo x Ceará: prováveis times, onde ver, desfalques e ... - Há 7 horas tempo real.

- Dapatkan link

- X

- Aplikasi Lainnya

Sturm Der Liebe Mediathek : Ard mediathek sturm der liebe vorschau | ᐅ 6 Wochen Sturm ... / Vanessa gibt endlich gegenüber max zu, dass sie sich in ihn verliebt hat.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar